#MINT lose 2nd spot to AREIT

Monday, November 30, 2020

Which REITs is leading the race? End Nov 2020

#MINT lose 2nd spot to AREIT

My Portfolio End Nov 2020

Since my last portfolio there are many changes, as I'm re-position my portfolio. In my last portfolio, I mention that I make 2 bad choice in investing ESR and Starhill REITs. I have sold them away this month. Start investing from late April till now, earning only $2,172.00 dividend. Will try to improve on future dividend earning.

|

Stock |

Holding |

Unrealised P/L |

Period of investment |

|

SATS Ltd. (S58.SI) |

6,000

|

40% |

Long term |

|

SIA Engineering (SIAE.SI) |

6,000 |

14% |

Long term |

|

Mapletree Commercial Trust (N2IU.SI) |

5,000 |

10% |

Long term |

|

CapitaLand Retail China Trust (AU8U.SI) |

14,000

|

1% |

Long term |

|

Frasers L&C Trust (BUOU.SI) |

5,000 |

12% |

Long term |

|

|

|

|

|

|

UMS Holdings Limited (558.SI) |

16,300 |

6% |

Short term |

|

Frencken Group Limited (E28.SI) |

6,600 |

15% |

Short term |

|

|

|

|

|

Monday, November 9, 2020

Which REIT is leading in the race?

Monday, November 2, 2020

Is this a best time to buy REITS?

SGX market is falling on Sept and Oct, price are getting lower. US election is not completed yet as of today 1/11/2020. Who will win? Will Monday continue to fall or rise? I think everyone is asking this question including me. What I think is this is the best time to buy good REITS at the lower price, and hence you get higher dividend yield.

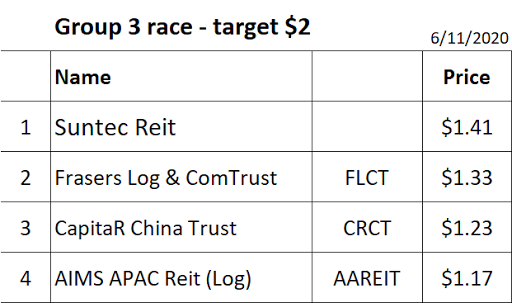

Let compare which REITS on sales.

There are some REITs didn't change much, that's why I didn't add into the table. Most of the REITS are oversold, just waiting for buyers to come in to push up the price. The question is when, maybe Monday is the day? Nobody know, so do you own research. This is just a reference even for myself.

I sold off my Suntec on Thursday during Ex Date, heng ah the price dip to $1.35 after I sold.

Happy shopping!

S-REIT with 100% exposure to China Market Part 3

Dasin Retail Tr (SGX: CEDU) EC World Reit (SGX: BWCU) Sasseur Reit (SGX: CRPU) CapLand China T (SGX: AU8U) BHG Retail REIT Sasseur...

-

T here are so many reits to choose, I group them in different groups. 1st tier - strong and stable reits 2nd tier - middle range price and ...

-

Group 1 REITs ParkwayLife Reit (C2PU) , very strong and stable REITs, the leader of this group. If you brought before March 2020 and still ...

-

SGX market is falling on Sept and Oct, price are getting lower. US election is not completed yet as of today 1/11/2020. Who will win? Will M...